DeFi Attacks On Ethereum Blockchain

One of the most exciting things happening in the world today is Decentralized Finance (DeFi), a space where financial institutions like banks do not exist. Instead, blockchain-powered protocols allow anyone with an internet connection to access the same suite of financial services that large, traditional financial institutions offer their customers.

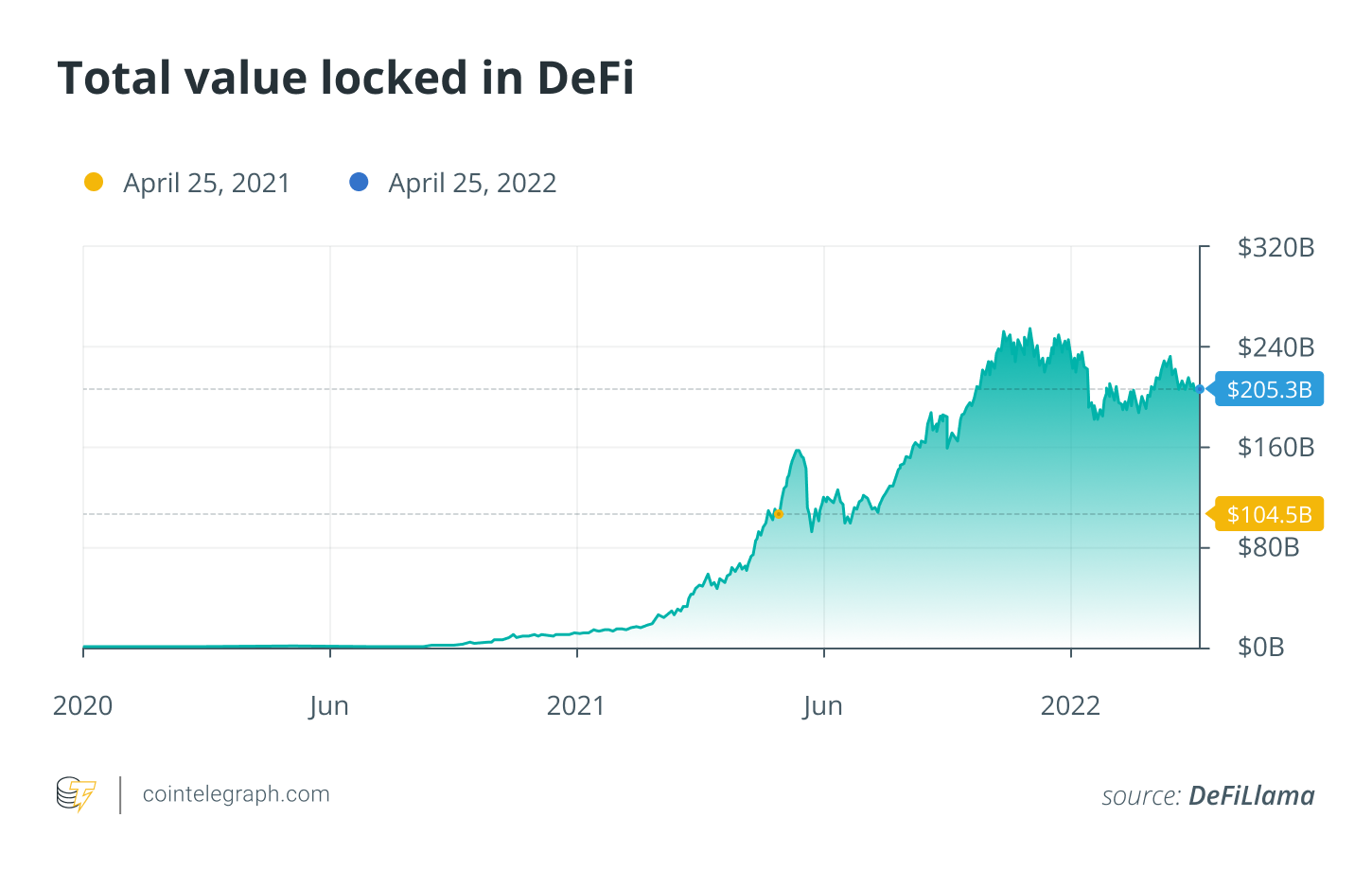

DeFi technology has the potential to revolutionize the financial system and has locked over 200 billion USD until April 2022, but it has been slow to gain real-world use. The significant barrier to DeFi's widespread acceptance is that when transacting using the DeFi protocol, all transaction information is transparent and open, which has resulted in a series of attacks.

It is critical to have a thorough grasp of these risks to define a blueprint for the financial world to have a brighter, more secure future. In this blog post, we examine the current DeFi market and how it has been impacted over time due to a lack of awareness of its risks and the various possible assaults on DeFi protocols, and a few techniques for ensuring more robust security in the DeFi ecosystem.

Current DeFi Market

The DeFi industry is predicted to grow rapidly over the next four years, with a sharp acceleration in 2022. According to some experts, the DeFi sector will reach the $3.5 trillion mark by 2022.

There has been an increase of$1 billion in the total value locked in the DeFi ecosystem which equals an increase of 147% during 2020. The growth of DeFi can be monitored through the most popular metric “Total Value Locked” in USD. The entire amount locked in DeFi rises from 600 million USD to about 200 billion USD between January 2020 and April 2022. In May 2022, there was a dramatic dip, causing markets to wonder about the rapid drop, and researchers stated that the drop was caused by the DeFi system's insufficient safety.

DeFi is not secure enough to prevent attacks, and existing countermeasures are ineffective in reducing the number of attacks. As a result, the security against DeFi must be improved. DeFi security audits are the only way to ensure that attacks like these do not happen in the future and help in the growth of this potential system.

What Is DeFi?

Decentralized Finance (DeFi) is a technology that allows new financial instruments, including payments, lending, trading, investments, insurance, and asset management, to be created without needing a trusted third party. These products and services are typically offered via decentralized applications (DApps) and decentralized infrastructure (Blockchain). It has the potential to provide cheaper and more accessible investments to the masses and is becoming the new face of finance.

Role Of Smart Contracts In Defi

Smart contracts have played a crucial role in the development of DeFi. They're leveraging decentralized finance to build an ecosystem that removes the third-party structure and executes transactions with a self-executing code between a buyer and seller. Some of the advantages of using smart contracts in a Defi system are

- Digitization

- Enhanced Security

- Speed and Accuracy

- Lower Transaction cost

- Transparency

- Protection against bribes

When comparing smart contracts to traditional contracts, the primary difference is that smart contracts' governance and execution are quick and self-dependent. As a result, the smart contract procedure is digital, which benefits both parties involved in the transactions. The entire process has been digitized, saving a significant amount of time, energy, and resources, and also becoming a highly secure system that can keep numerous records, providing better scope for auditability and accessibility.

Vulnerabilities In A DeFi Ecosystem

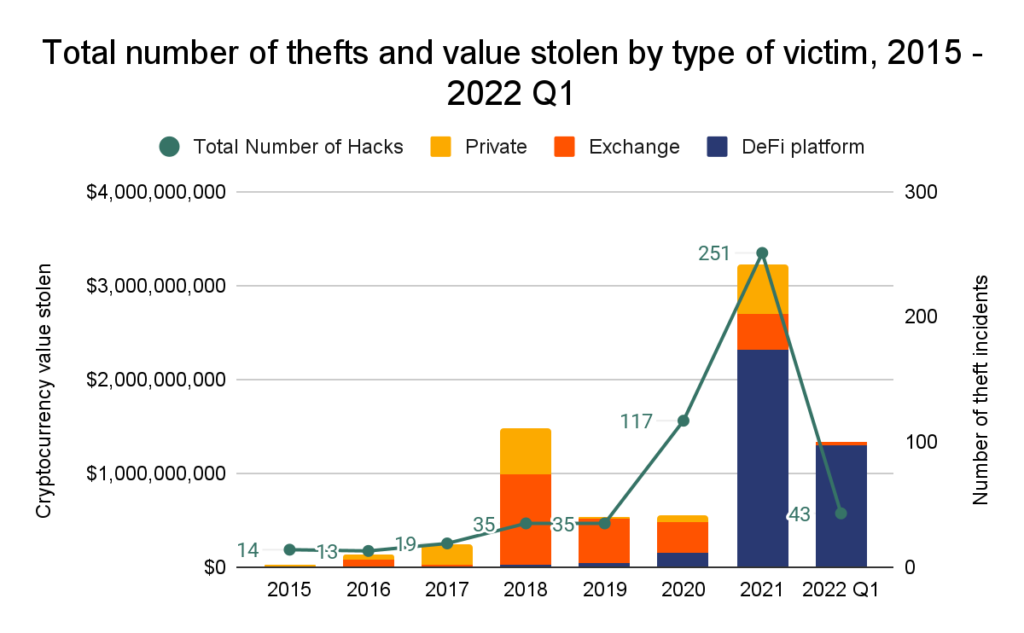

According to Chainalysis, 97% of all cryptocurrency stolen in the first three months of 2022 has been taken from DeFi protocols, up from 72% in 2021 and just 30% in 2020. Shockingly, these attacks have overlapped with DeFi's exponential growth.

Vulnerabilities have always existed in the DeFi ecosystem, but due to its growing popularity, hackers found more and more ways to exploit the system, and 2022 is proof of that.

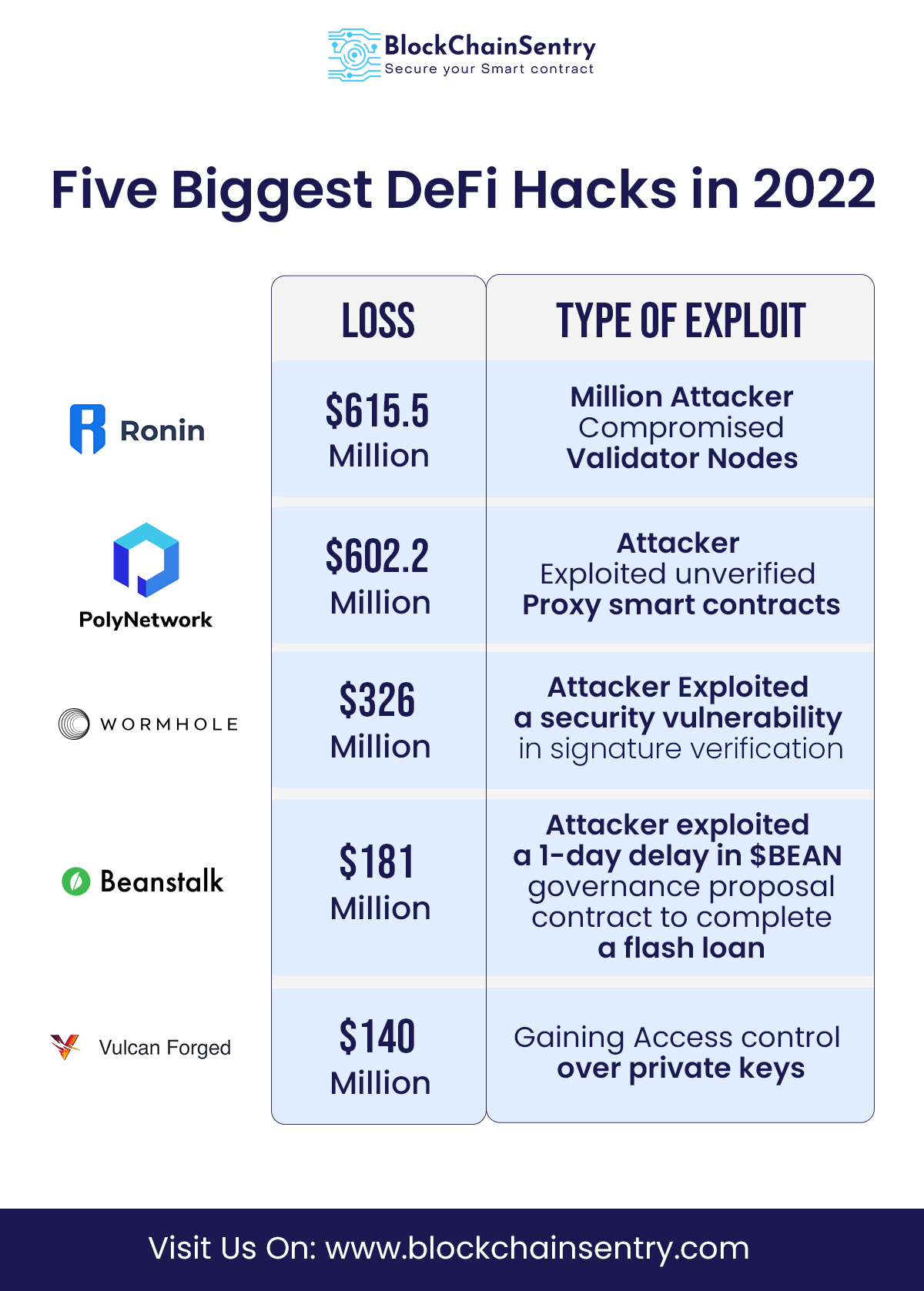

Five Biggest DeFi Hacks In 2022

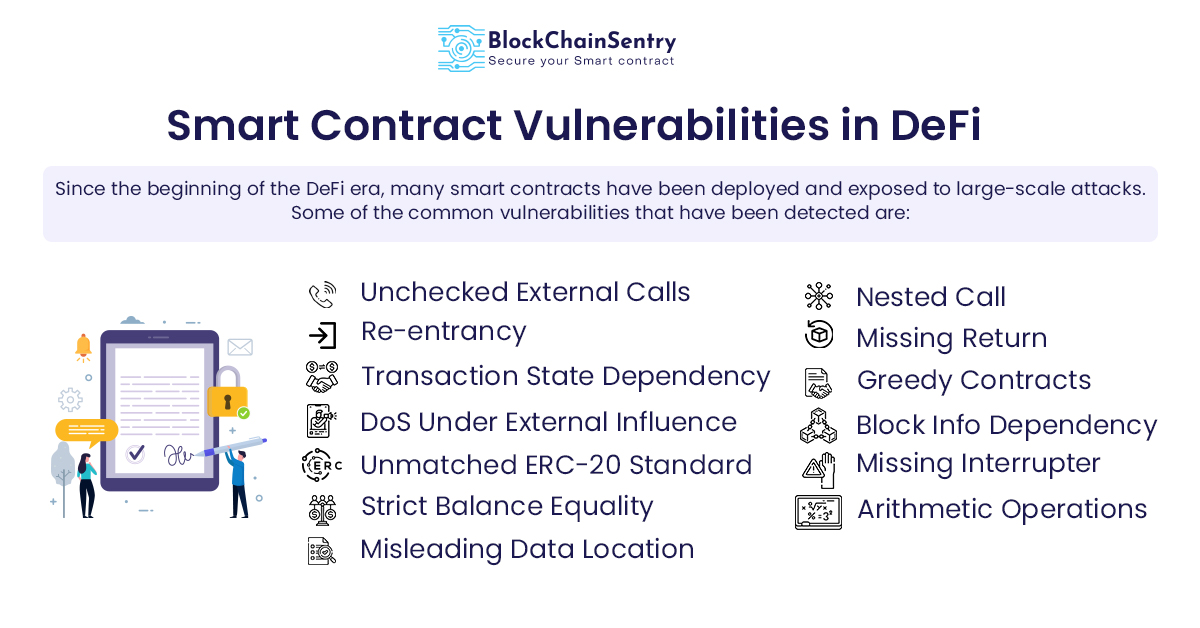

Smart Contract Vulnerabilities In DeFi

Need For DeFi Smart Contract Auditing

With so much dependency on smart contracts, DeFi audits are becoming increasingly important, as a security audit can verify every line of code and assist in discovering vulnerabilities and weaknesses.

If the DeFi contracts are not audited, they may result in setbacks like money loss and system manipulation, etc. It can also result in a company's closure or significant brand damage for entrepreneurs that use DeFi systems. As a result, you must evaluate the quality of your smart contract code to ensure that it is protected from threats and risks.

Cyber-attacks involving DeFi smart contracts must be avoided at all costs, especially when money is involved. The DeFi business has already suffered $3 billion in catastrophic losses as a result of DeFi hacks. DeFi protocols are continually studying comprehensive approaches to DeFi security with this in mind. BlockChainSentry, a blockchain security firm specializing in Ethereum-based blockchain, provides realistic solutions for companies concerned about DeFi security.

The vulnerability management solution provided by BlockChainSentry functions as an automation tool to protect your DeFi smart contracts and assist you in building secure smart contracts.

While the developments in DeFi are impressive, they have yet to be validated. It's difficult to say how DeFi will affect the future financial economy but, the DeFi sector remains volatile and vulnerable to serious attacks, despite the fact that several protocols have attracted large capital and the related network effects in a short period of time.

Developers on the other hand are working hard to address vulnerabilities and create new risk management mechanisms, thus the process is never-ending. DeFi's ultimate success or failure will be determined by its ability to deliver on its promise of an open, trust-free, and zero-loss solution.