All about Ethereum 2.0 transition

Blockchain technology came into existence at the start of the 90s,' and it took more than two decades when in 2014, the Ethereum blockchain system was introduced. To trade cryptocurrency in Ethereum, smart contracts were written on the blocks, where cryptocurrencies can be traded in a decentralized network. The oldest cryptocurrency in the world is Bitcoin, and to date, it is the world's most popular and recognized cryptocurrency. After Satoshi made bitcoin available to the public in 2008, a community of blockchain academics and developers came up to contribute to the open source development of bitcoins. One of the community members, Vitalik Buterin, a writer for Bitcoin Magazine, began to look into the potential abilities of blockchain outside of cryptocurrencies. Even though Ethereum did not have the same revolutionary impact as Bitcoin, Vitalik took lessons from it and created additional functionalities based on its ideas before publishing Ethereum's white paper in 2014. It suggested a brand-new all-purpose blockchain that may be utilized as a decentralized application framework that supports smart contracts. The system owned its native currency, Ether, and a new environment called the Ethereum Virtual Machine (EVM).

What is Ethereum 1.0?

Ethereum 1.0 is a decentralized application platform that underpins blockchain technology. It allows anyone to develop secure digital technology(Dapp, DeFi, NFTs, DAO) with the help of smart contracts. Ethereum soon became a choice for businesses and developers who are building technology on top of it to transform several sectors and how we live our daily lives. There are around 2970 projects built on Ethereum with over 50.5M smart contracts and about 1.158M transactions today.

Limitations of Ethereum 1.0

Even though Vitalik launched Ethereum projects successfully, it has seen its fair share of difficulties within some months of launching. For instance, the famous DAO hack that took place used a flaw in one of the projects created on top of Ethereum to steal $50 million worth of the token. The creators then decided to split the blockchain to reclaim the money that had been stolen. The Ethereum Classic, which resulted from that fork, is still used today.

Ethereum has grown to be widely used across numerous cryptocurrency projects, and its network having trouble keeping up with the volume of traffic. This issue has gotten so bad that it occasionally causes network instability. The network can only support 15 transactions per second, making transaction speed a primary concern for this network. The fees (gas) paid for a transaction are incredibly high at times due to high demand. Thus many competitors like Cardano, Polkadot, Hyper Ledger Fabric, etc., grew as an alternative for Ethereum. These developer blockchains have a similar framework to Ethereum but with higher transaction output and traffic capacity.

Ethereum's network consensus relies on proof of work (PoW), which is another important drawback. Blocks are more challenging to mine due to the explosive combination of strong traffic and high demand. This results in a slower procedure that is also far more expensive. To create blocks and enable the network to advance, Ethereum miners require greater power. According to Digiconomist, Ethereum uses roughly 112 terawatt-hours of electricity annually. On Ethereum, a single transaction is equivalent to the energy used by a typical US home over nine days. As a result, when many users attempt to utilize the network simultaneously, it becomes slower and more expensive. Ethereum came up with the launch of Ethereum 2.0 to overcome all these issues.

Ethereum 2.0 into the picture

The primary focus of Ethereum 2.0 was to make this network more scalable, secure, and sustainable.

In Ethereum 2.0, the Proof of Work(PoW) consensus is now transitioning to a Proof of Stake (PoS). Proof-of-Stake lessens the amount of computing required to validate blocks and transactions. To validate blocks, the owners submit their currencies as collateral. Owners of staked coins are known as "validators"; they confirm blocks. The block is then "mined" or selected randomly by validators. Instead of employing a competition-based process like proof-of-work, this system randomly selects who gets to "mine."

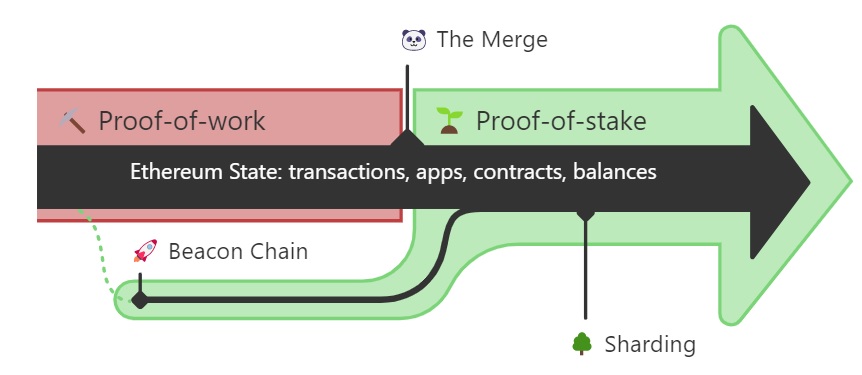

The process of upgrading Ethereum to the 2.0 version is divided into three stages.

Stage 1: The Beacon Chain

The Beacon chain introduces the Proof of Stake (Pos) consensus to the Ethereum platform. The first phase went live in December 2020. The Beacon Chain is focused on enabling Ethereum staking. Stakeholders will now be able to use validator software. The technique ensures that a small number of validator nodes don't have a monopoly on network control. The capability opens the door for ETH 2.0's next phase, which will rely on the PoS mechanism.

Stage 2: The Merge

At this point, the Ethereum Mainnet and the Beacon Chain Proof-of-Stake network will merge. This will complete Ethereum's shift to proof-of-stake and signal the end of proof-of-work.

This paves the way for later scaling improvements like sharding. Ethereum's energy use will be reduced by 99.95% due to the Merge. The Merge is expected to roll out on August 11th, 2022.

Source: https://ethereum.org/en/upgrades/merge/

Stage 3: Sharding

Sharding is the process of horizontally dividing a database to distribute the load. As a result, network congestion will continue to decline, and transactions per second will rise. Sharding is a multi-stage update to Ethereum that increases its capacity and scalability. Sharding offers a safe way to distribute the need for data storage, making roll-ups even more affordable and nodes simpler to manage. They make it possible for layer 2 solutions to provide minimal transaction fees while utilizing Ethereum's security. After the Mainnet and Beacon Chain Merge in 2023, the shrading is anticipated to be implemented.

Final Thoughts

The global business industry and Ethereum community are eagerly awaiting the release of version 2.0. Ethereum will rise to new heights in the coming years and cause significant upheaval in the blockchain market. Only after the complete transformation will we be able to determine if Ethereum we know will become more scalable, secure, and sustainable.